What is an Investment Linked Insurance Plan?

An investment-linked insurance plan is a hybrid life insurance product that combines aspects of both life insurance and investments. In this product, a section of the premium is paid off to purchase the life insurance component while the remaining bit is used to acquire units in a Unit Trust (also known as a Mutual Fund).

As you can see, ILPs offer a bit of both insurance and investment, read on to understand the merits and demerits.

Investment linked insurance plans (ILPs) have been soaring in Singapore in the recent past. According to the Life Insurance Association (LIA), by the end of the third quarter of 2015, they accounted for over 20% of all new insurance premiums paid. This was the backdrop of dwindling figures for health insurance and other life insurance products.

But what makes this product soar? Is it an aggressive campaign by the insurance companies or is it a must-buy for all consumers who seek to secure their financial futures? We shall indulge to know what is an investment-linked insurance plan, its merits, as well as the demerits to help you to make a sound decision if it is worth it

What is an Investment-Linked Insurance Plan?

An investment-linked insurance plan is a hybrid life insurance product that combines aspects of both life insurance and investments. In this product, a section of the premium is paid off to purchase the life insurance component while the remaining bit is used to acquire units in a Unit Trust (also known as a Mutual Fund).

As you can see, ILPs offer a bit of both insurance and investment, read on to understand the merits and demerits.

Merits

ILPs are flexible regarding coverage, choice of fund to invest in, and premium payment. The policyholder can change the coverage he or she wants depending on their suiting. This enables younger subscribers, who have less financial responsibilities invest more in the Unit Trusts. To building bigger investment portfolios and as they grow older and add financial responsibilities. So, they can ease up on the investment part and increase insurance coverage.

In addition, policyholders have the flexibility of choice between various funds they would prefer to invest in.

Policyholders also have the option of taking a premium pause. During such a break, the insurance component is drawn from the existing mutual fund. So to helping policyholders get through tough financial times without compromising their life insurance cover.

That’s just about it on the merits; now let us look at the other side of the coin.

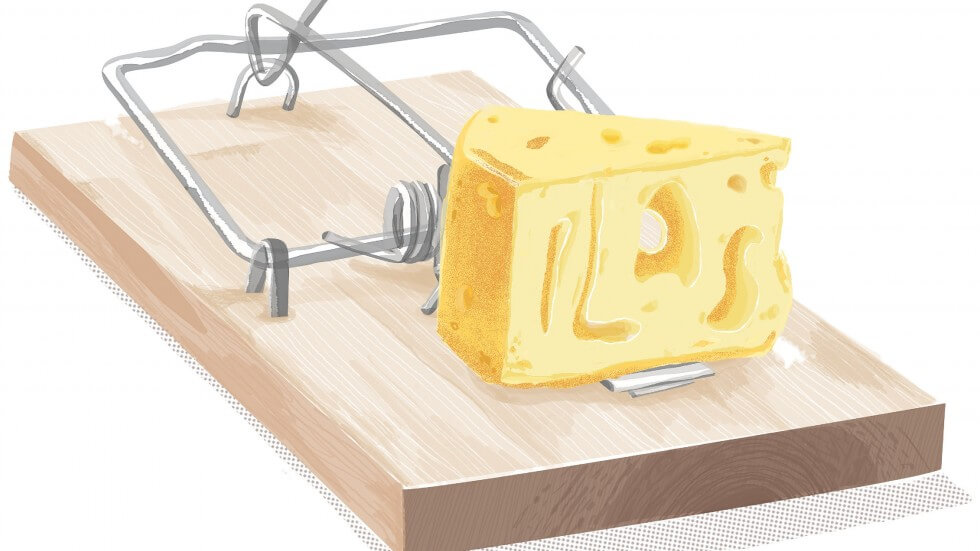

Demerits

The first and almost obvious demerit attached to the product is its’ cost ineffectiveness. When you purchase an ILP, much of the initial premium payment meets the distribution costs of the product. This takes a good chunk (as much as 40%) off your premium.

In addition to these exorbitant distribution costs, there are other hidden costs involved such as fund management fees. And they typically amount to about 1.5% of the fund and monthly administrative fee and account maintenance fees. Also, all of which may total up to 5% annually.

Get the ‘Worst’ of Both Products

Due to the inherent nature and high distribution costs, neither the investment nor the insurance component of the product can reap the optimum value for a policyholder. Much of the initial year’s premiums are lost in distribution fees for an ILP investor. As your insurance needs grow, the investment component is depriving at the cost of funding the insurance part. And this which demands a higher amount. As an insurance product, the coverage is much less than what is available under a regular endowment or term life plan.

ILPs have been aggressively promoting over the last few years, the above merits and demerits will help you see if they are really worth purchasing.

Credit Review

Credit Review will be able to help you find the best moneylenders in Singapore. We do this because we know how hard it is to find a good money lender despite the size of Singapore.

We will only show you the best money lenders in Singapore. Why do we not show you everything for you to choose from? This is because if we are to show you every single legal money lender in Singapore, it is not helpful at all. There are so many lists showing all the money lenders. Even a list from the Ministry of Law’s site! By showing you only the best money lenders. So, you know you are getting a loan from the most reliable money lenders. This will be especially helpful when you are in urgent need of money. Furthermore, it will help you lessen the time you need to find good moneylender. It will also mean that you will be able to resolve your problems quickly.

If you are looking for good money lenders in Singapore, have a look through Credit Review.

Any questions you may have about legal or licensed money lenders in Singapore, you can call us at +65 6850 5412. Otherwise you can approach the money lender directly and ask them your questions ?